Dylan Jovine: Behind The Markets & Stock Picks - [Reviews & Insights]

Is it possible to consistently beat the market and unearth investment opportunities that Wall Street overlooks? The story of Dylan Jovine, a Wall Street veteran who claims to do just that, offers a compelling, albeit complex, narrative for anyone looking to navigate the turbulent waters of financial markets.

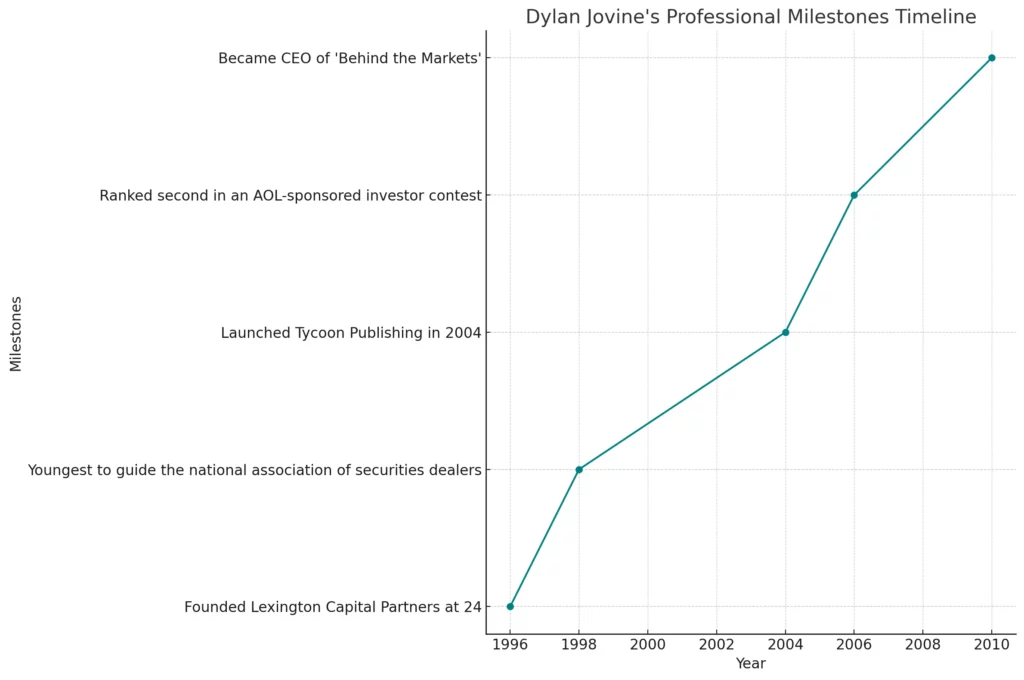

Jovine's journey began on Wall Street in 1991. His early knack for identifying stocks poised for takeovers quickly gained him recognition. This skill eventually led to the founding of his own brokerage firm, Lexington Capital Partners, in 1996. However, his career path diverged when he transitioned into the realm of investment research, establishing "Behind the Markets," a company that offers newsletters and courses, promising subscribers access to insights often missed by the mainstream financial world.

| Attribute | Details |

|---|---|

| Full Name | Dylan Jovine |

| Known For | Founder of "Behind the Markets," Former Wall Street Manager, Stock Picker. |

| Born | Information Not Publicly Available |

| Education | Information Not Publicly Available |

| Career Highlights | Began on Wall Street in 1991; Founded Lexington Capital Partners (brokerage firm); Founded "Behind the Markets" (investment research company); Tycoon Publishing founder (2004), later part of Agora Financial (2011) |

| Areas of Expertise | Financial analysis, investment research, identifying undervalued stocks. |

| Current Role | Chairman & CEO of "Behind the Markets" |

| Location | Based in Delray Beach, Florida (as per LinkedIn profile) |

| Notable Campaigns/Products | "Behind the Markets" Newsletter, Teaser ad campaigns on topics like the "5G weapon" and "Nvidia's secret royalty," "The New Space Race" |

| Website Reference | Dylan Jovine's LinkedIn Profile |

Jovine's investment strategy appears to focus on identifying what he believes are overlooked opportunities. He claims to follow the stocks of billionaires and insiders. One of his marketing strategies involves teaser ads that often present intriguing and sometimes controversial concepts, such as the "last retirement stock you'll ever need," which he links to Nvidia and potential "royalties" from Google searches. Another recent example is a pitch centered on a "5G weapon," described as a "5G arrow," further attracting attention. These campaigns aim to spark curiosity and encourage subscriptions to his "Behind the Markets" newsletter.

- Alice Rosenblum Latest Leaks Info What You Need To Know

- Katy Perrys Dating Timeline From Bloom To Past Loves Relationships

A new entry-level newsletter from Jovine appeared in 2018, after he had previously run the Tycoon Report. This latest venture continues to focus on recommending "undiscovered stocks Wall Street doesn't know about yet." He positions himself as an expert who can see past the mainstream focus on large-cap stocks like Netflix, Amazon, Google, and Microsoft, the companies that Wall Street spends the majority of its time focusing on.

While Jovine's promotional materials often highlight his past successes and experience, it's crucial to approach such claims with a critical eye. As some reviews indicate, the performance of his stock picks varies significantly, depending on factors like the specific company, the entry price, and the broader market context. His services may have performed well during bull markets like 2018 and 2021, but past performance is never a guarantee of future results. A critical review of the recommendations he offers and their performance is crucial for any investor.

In a market dominated by 14,000 publicly traded stocks, Jovines claim to focus on overlooked, undervalued opportunities does resonate with the desire to identify potential gains. The constant pressure from Wall Street to recommend the same big companies opens a space for those who can find a new approach. Here at Greenbullresearch.com, they attempt to uncover recommendations by Dylan Jovine and others for free to assist in the decision making.

- Celine Dions Heartbreak Funeral Of Ren Anglil Details Tributes

- Alice Rosenblum Latest Leaks Free Porn Watch Now

Jovine often leverages his history to build credibility. In the early 1990s, he earned a reputation for spotting stocks just before takeovers, a skill that undoubtedly contributed to his initial success. He emphasizes his 30 years of experience, a significant period in the financial world, and highlights that he's witnessed both the early, pre-internet market and the modern, technologically-driven landscape. His claims of consistent success throughout his career are central to his branding.

Beyond "Behind the Markets," Jovine's involvement with Tycoon Publishing, founded in 2004 and later becoming part of Agora Financial in 2011, further indicates a broader business approach to the financial advisory space. Agora Financial is a well-known publisher of financial newsletters and research reports. This background suggests a degree of sophistication in marketing and reaching potential subscribers.

One persistent theme in Jovine's marketing is the use of special reports to tease potential investment opportunities. Recent examples include reports focused on "The New Space Race," linking it to companies tied to the war in Ukraine, as well as aerospace and missile companies. The "5G weapon" campaign is another example of a report designed to pique interest and generate leads. These special reports are presented as exclusive insights, offering a glimpse into areas that are purportedly under-recognized by the mainstream financial community.

As the editor and lead stock picker at "Behind the Markets," Jovine oversees the production of the online newsletter, which provides subscribers with stock recommendations, trade alerts, and bonus reports. This form of marketing is a regular practice for investment advisors. The crucial aspect for any consumer is to identify how this one differentiates itself in the market and assess its value proposition.

One of the common threads in the discussion about Jovine is a reference to a "cut and paste disease" story, which has been a key component of his "Behind the Markets" ($39/year) newsletter marketing for about five years. This shows a consistent strategy that capitalizes on the power of a narrative, and the long-term effectiveness of his method suggests it resonates with his target audience. It is important to assess and re-evaluate these claims to make informed investment decisions.

Jovine positions himself as someone who can identify undervalued stocks. In a market constantly focused on large, established companies, the promise of discovering unique investment opportunities can be tempting. His pitch resonates with individual investors seeking potentially high returns. The narrative often emphasizes unique, overlooked chances, which can be a powerful motivator for those looking for ways to diversify.

The fact that he was hired by Peter Jaquith, an investment banker known for his role in saving New York City from bankruptcy, is another piece of the biography Jovine uses to build credibility. This association seeks to draw a connection between himself and figures with a solid record of success.

When evaluating any investment advisory service, it is crucial to gather as much information as possible. Independent reviews and ratings from other investors can be extremely helpful in making decisions. Feedback from real-world subscribers provides critical perspective on the effectiveness of the service and the quality of the recommendations.

The existence of a short introductory video, where Jovine explains his service and investment philosophy, provides another way for potential subscribers to learn more about him. This is part of the standard marketing playbook for financial newsletters, allowing for a personal connection with potential clients and a clearer understanding of the company's approach.

The reports Jovine creates about the different companies he recommends are available for review. Examining these reports is key to assessing the validity of his claims and the rigor of his research. This level of transparency is essential for making informed choices. The "bronze" package is one of the entry level options available to potential investors.

Investors must approach financial newsletters, especially those with aggressive marketing, with significant caution. Dylan Jovine's story presents a compelling case, filled with intriguing claims and experience. But it is essential to evaluate these statements with a critical mindset, seeking independent confirmation of the claimed results, and considering the risks inherent in any investment decision. Due diligence is vital, as it will assist in making smart decisions and avoiding financial fraud.

Article Recommendations

Detail Author:

- Name : Alexane Mosciski PhD

- Username : joan.von

- Email : diamond71@hotmail.com

- Birthdate : 1983-09-12

- Address : 503 Markus Greens Apt. 221 New Lexie, AR 43479-4918

- Phone : (341) 779-3202

- Company : Bailey and Sons

- Job : Petroleum Pump System Operator

- Bio : Quos recusandae non ea quam nobis omnis. Officia ab dolore delectus quidem animi. Qui pariatur recusandae dolorem distinctio nesciunt ipsam.

Socials

twitter:

- url : https://twitter.com/moshe.stokes

- username : moshe.stokes

- bio : Et et deserunt autem eius numquam amet. Eum qui aperiam et fugiat. At harum est dicta molestiae repudiandae ea quibusdam.

- followers : 4039

- following : 1821

facebook:

- url : https://facebook.com/stokes1979

- username : stokes1979

- bio : Qui voluptatem repellat dolorum molestiae illo.

- followers : 5463

- following : 2468

tiktok:

- url : https://tiktok.com/@moshestokes

- username : moshestokes

- bio : Eius ea ad quia ullam blanditiis.

- followers : 3108

- following : 2968